Token:

*** Cryptocurrencies and NFTs are volatile and those who invest in the should be prepared to lose all their money. NOTHING www.howtopulse.com states, shares, expresses, or allude to should be considered professional advice or recommendations of action. This blog is intended for educational and entertainment purposes only. Consult a professional (or two…or more) for any tax, accounting or legal related questions you may have. Howtopulse did not receive any payments to write this blog or any other post on this site

Token ticker: HDRN

Total current supply: 76,821,350,035,004 HDRN while the circulating supply is 43,131,539,105,507 HDRN The supply depends on the quantity of HDRN token minted and burned which may vary from day to day. It’s an ERC-20 token and a PRC-20 token on PulseChain.

About:

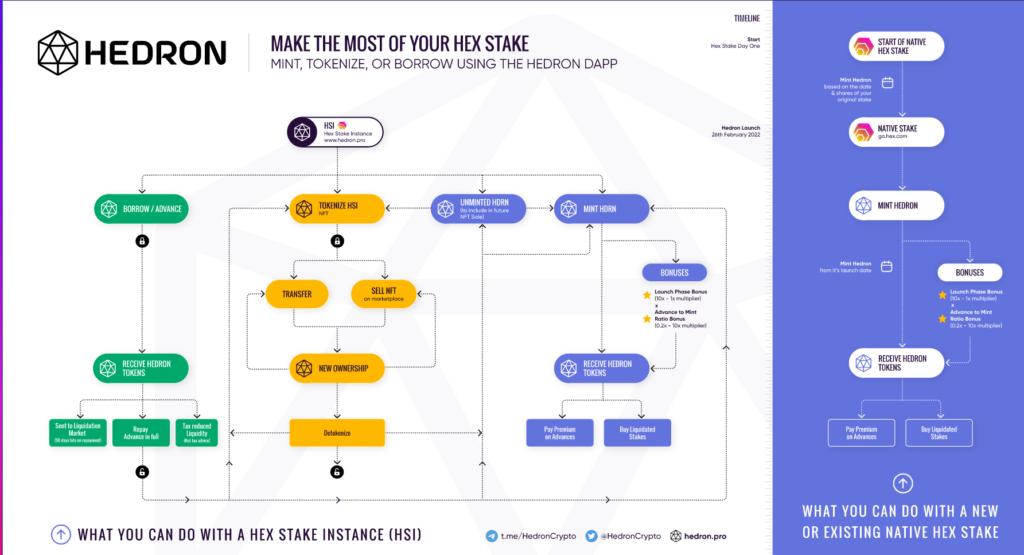

Hedron builds on top of HEX rewarding HEX stakers with HDRN tokens. HEX is the first Certificate of Deposit buil on blockchain. Hedron’s set of smart contracts allows stakers to claim the Launch Phase Bonus (LPB), mint HDRN, tokenize the stake and take an advance on their stake. Tokenized stakes can be sold or auctioned off on secondary NFT marketplaces. Hedron is audited, has no counterparty risk, and has no admin keys. Borrowing HDRN means burning liquidity from the system because payments and the interest paid are burnt.

HEX stakers who created their stakes through the Hedron smart contract don’t need to Emergency End Stake their stakes anymore. Now they can just use the ‘tokenize’ function and sell the stake to someone else potentially reducing HEX sell pressure. When stake ownership is transferred, the state of any mintable HDRN and/or any bonuses attributed to the HSI is also transferred.

The new owner can mint available HDRN or get an advance. HEX stakes that haven’t used Hedron prior to their creation, the so-called native stakes, can only claim bonuses and mint HDRN while new HEX stakes created through Hedron and called HEX Stake Instances (HSIs) can use all the functions like minting, tokenizing, advancing.

HDRN tokens can be minted each day based on the B-shares a stake contains and on the number of days passed from the beginning of that stake.

The contract allows to mint 1 HDRN for 1 B-share where 1000 B-shares equal 1 T-share.

Users who participated in the first 100 days of Hedron’s launch could claim the LPB bonus that started from 10x multiplier. The stake keeps the bonus for the whole length. This is important information when it comes to auctioning off the stake or taking an advance on it.

Instanced HEX stakes are eligible to take an advance on the totality of unminted HDRN that a stake can ever produce. What a user does is to take in advance what is due to him at a certain future date and pay back the loan in HDRN. Instanced (HSI) HEX stakes with active HDRN advances cannot End Stake until the advance is paid back in full (Good Accounting can still be used). The instalments need to be repaid every 30 days and when there’s a delay of 90 or more days the stake is made eligible for liquidation. Borrowed payments and the interest paid are burned reducing token supply.

Features:

Utility:

- Mint HDRN to reward HEX stakers

- Tokenize HEX stake to sell it on an NFT marketplace

- Advance loans on a HEX stake

- Buy liquidated loans

Links:

Website: https://hedron.pro/#/

Telegram: https://t.me/HedronCrypto

Twitter: https://twitter.com/HedronCrypto